Results for the six months ended 30 june 2017

"G4S Chief Executive Officer Ashley Almanza said, “In the first half of 2017 our continuing businesses delivered revenue growth of 6.2% and earnings growth of 7.6%."

We continue to invest in strengthening our sales operations and in new products and services for our customers and these investments have materially improved our sales pipeline which supports our medium term aim of growing revenues by an average of around 4-6% per annum. Our well established productivity programme provides increased confidence in the Group’s ability to deliver recurring operating and financing efficiencies of £90 million to £100 million by 2020. We believe that this combination of investment, growth and productivity will deliver strong growth in the Group’s earningsa and operating cash flow.”

Operational and financial highlights:

- Sales pipeline: £7.0 billion annual contract value

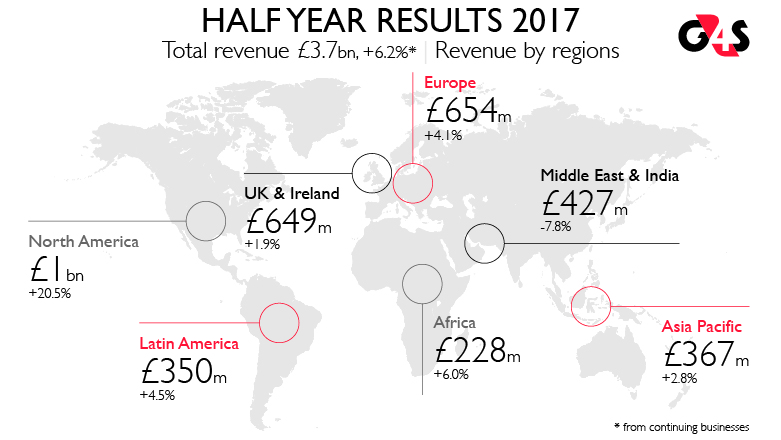

- Revenue +6.2%a with growth across all regions except Middle East & India

- Operating cash flowa,c £192 million (2016: £277 million); weighted to H2 2017 in line with guidance

- Net debt to EBITDA improved to 2.7x (30 June 2016: 3.3x); expect 2.5x or lower by year end

- Continuing EPS 8.3p +7.8% (2016: 7.7p); statutory EPS 9.7p +115.6% (2016: 4.5p)

- Interim dividend 3.59p (2016: 3.59p)

Group results

|

Continuing Businessesa Constant Rates |

Statutory Resultsb Actual Rates |

|||||

|---|---|---|---|---|---|---|

|

2017 |

2016 |

% |

2017 |

2016 |

% |

|

|

Revenue |

£3,715m |

£3,497m |

+6.2 |

£3,972m |

£3,532m |

+12.5 |

|

PBITA |

£235m |

£222m |

+5.9 |

£237m |

£203m |

+16.7 |

|

Earnings |

£128m |

£119m |

+7.6 |

£150m |

£69m |

+117.4 |

|

Earnings Per Share |

8.3p |

7.7p |

+7.8 |

9.7p |

4.5p |

+115.6 |

|

Operating Cash Flowc |

£192m |

£277m |

-30.7 |

£170m |

£273m |

-37.7 |

a Results from continuing businesses, presented at constant exchange rates other than for operating cash flow, exclude results from businesses identified for sale or closure and onerous contracts. The basis of preparation of results of continuing businesses and an explanation of Alternative Performance Measures is on page 3.

b See page 19 for the basis of preparation of statutory results. Statutory earnings represent profit attributable to equity shareholders of G4S plc. Statutory operating cash flow is net cash flow from operating activities of continuing operations.

c Operating cash flow is stated after pension deficit contributions of £20 million (2016: £24 million) and 2016 amounts are presented at actual 2016 exchange rates. Operating cash flow from continuing businesses is reconciled to the Group movements in net debt on page 30.

G4S strategy and investment proposition

G4S is the world’s leading, global integrated security company, providing security and related services across six continents.

Our strategy addresses the positive, global demand outlook for security services and our enduring strategic aim is to demonstrate the values and performance that make G4S the company of choice for customers, employees and shareholders. We aim to do this by designing innovative solutions, by delivering outstanding service to our customers, by providing engaging and rewarding work for employees and by generating sustainable growth in returns for our shareholders. These aims are underpinned by the key programmes in our strategic plan:

- People and Values

- Growth and Innovation

- Customer Service Excellence

- Productivity and Operational Excellence

- Financial and Commercial Discipline

The Group has two business segments: Secure Solutions and Cash Solutions. Security and safety are critical to our success in both segments.

Secure Solutions: we design, market and deliver a wide range of security and related services and our global business provides valuable access to a highly diversified customer base in markets around the world. Our security services range from static manned security to highly sophisticated, integrated solutions. Our scale and focus on productivity supports our cost competitiveness and our sustained investment in professional staff, technology, software and systems enables us to provide valuable and integrated solutions for our customers.

Cash Solutions: we transport, process, recycle, securely store and manage cash and we provide secure international logistics for cash and valuables. We invest in technology and know-how and develop and sell proprietary cash management systems which combine skilled professionals with software, hardware and operational support in an integrated managed service. We operate around the globe, focussing on markets where we are able to build and sustain a material market share in our key service offerings.

G4S’s investment proposition is to deliver sustainable growth in earnings, cash flows and dividends.

Outlook

G4S Group Chief Executive Officer, Ashley Almanza, commented: